Silver’s Soar: Navigating the Peak at £0.73 per Gram on the UK Market

In the ever-dynamic world of commodities, silver has recently made headlines with its price reaching an all-time high of

0.73 per gram in the UK market. This article for Goldbulliondealers.co.uk delves into the intricacies of the silver market, examining the factors that have led to this unprecedented surge and providing insights into market dynamics, economic indicators, and strategic investment decisions. We also explore the future outlook for silver, offering projections and considerations for investors looking to navigate these volatile times.

Key Takeaways

- Silver prices have hit a record peak in the UK at

0.73 per gram, indicating a significant surge in the precious metals market. - Investor behavior is shifting, with a notable move from SLV to Sprott’s PSLV, amidst rising inventory levels reaching 424.085 million oz.

- Global economic indicators such as bond yields and currency fluctuations are playing a pivotal role in influencing the precious metal markets.

- Investors are advised to consider both long-term and short-term investment approaches in light of the current volatility in commodity investments.

- Expert analyses and market forecasts suggest potential risks and opportunities, with silver maintaining a critical position in the future commodity landscape.

The Unprecedented Surge in Silver Prices

Analyzing the Current Peak of Silver

The recent peak in silver prices at £0.73 per gram in the UK market marks a significant milestone, reflecting a complex interplay of market forces and investor sentiment. The surge to this unprecedented level warrants a meticulous examination of the underlying factors and market dynamics.

Silver’s performance can be analyzed through various lenses, including historical trends, supply-demand equations, and macroeconomic indicators. A comparative look at the price movements over the past quarters reveals patterns that may help in understanding the current peak:

| Quarter | Silver Price (per gram) | Change (%) |

|---|---|---|

| Q1 2022 | £0.55 | – |

| Q2 2022 | £0.60 | +9.09 |

| Q3 2022 | £0.65 | +8.33 |

| Q4 2022 | £0.73 | +12.31 |

The trajectory of silver prices is not only a reflection of investor behavior but also a barometer for broader economic health. As such, the peak in silver prices may signal shifts in both market sentiment and economic outlook.

Understanding the peak requires a multi-faceted approach, considering both quantitative data and qualitative insights. The role of global economic events, shifts in investment strategies, and technological advancements in mining and refining processes are all critical components that shape the landscape of silver pricing.

Factors Contributing to the Price Escalation

The recent surge in silver prices can be attributed to a complex interplay of market forces. Among the primary factors affecting silver bullion prices in the UK are supply and demand, economic stability, geopolitical events, and currency values. The Royal Mint and various online trading platforms have emerged as key players in the market, influencing both liquidity and accessibility for investors.

Trends indicate an increased interest in silver bullion investment, which has been reflected in the market dynamics. The following points outline the core contributors to the price escalation:

- Heightened demand for silver in industrial applications, particularly in the renewable energy sector.

- Investment demand driven by economic uncertainty, leading to a rise in safe-haven asset purchases.

- Fluctuations in currency values, with the pound’s strength influencing silver prices.

- Geopolitical tensions that have spurred investors to diversify their portfolios with precious metals.

The convergence of these factors has created a bullish market for silver, propelling prices to unprecedented levels. While the allure of silver continues to grow, it is imperative for investors to remain cognizant of the underlying drivers of its value.

Comparative Analysis with Other Precious Metals

The recent peak in silver prices has not occurred in isolation; it reflects a broader trend across the precious metals market. Gold, traditionally a bellwether for precious metals, has also seen significant price movements. However, silver’s percentage increase has outpaced that of gold, underscoring its volatility and potential for rapid gains. Platinum and palladium, while also experiencing fluctuations, have not mirrored silver’s sharp ascent.

The divergence in performance among precious metals highlights the unique factors influencing each market.

You can view the Live Gold and Silver Price below:

https://goldbulliondealers.co.uk/live-gold-and-silver-prices/

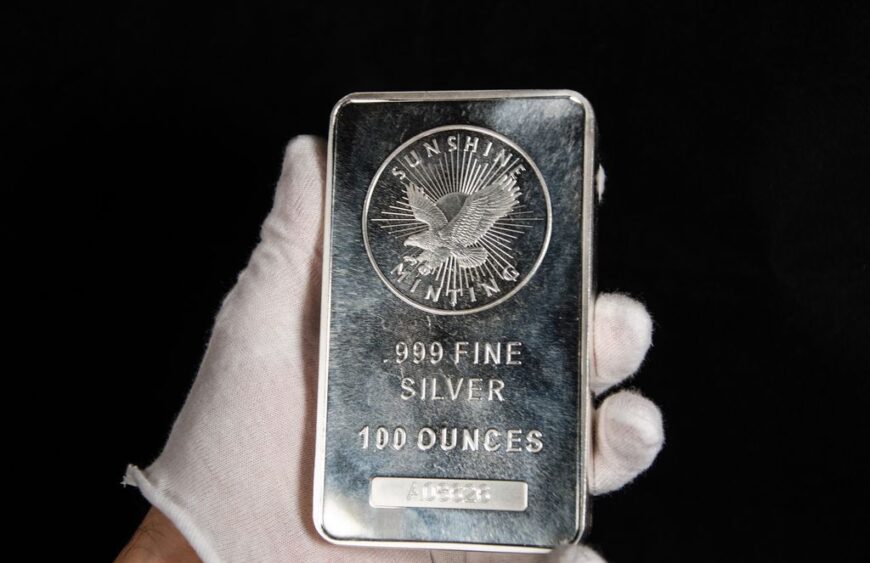

Investors often consider silver bars as a tangible asset within their portfolios. The guide to types of silver bars in the UK market, factors affecting prices such as demand, economic indicators, and supply, alongside options for selling and shipping, are crucial for informed investment decisions.

Market Dynamics and Investor Behavior

Shift from SLV to Sprott’s PSLV

In recent times, a significant trend has emerged in the silver investment community: a shift from the traditional Silver-backed exchange-traded fund (ETF), SLV, to the Sprott Physical Silver Trust (PSLV). Investors are increasingly favoring PSLV over SLV due to concerns about the actual physical silver backing SLV holdings.

Recent inventory changes highlight this shift:

| Date | SLV Inventory Change (Million OZ) |

|---|---|

| March 28 | +1.005 |

| March 27 | +1.691 |

| March 26 | +0.366 |

| March 25 | -3.887 |

| Feb 8 | No change |

| Feb 7 | +4.04 |

The table above succinctly captures the fluctuations in the SLV inventory, with notable deposits and withdrawals that reflect investor behavior. The preference for PSLV is partly due to its reputation for holding fully allocated, segregated silver bullion, which provides a sense of security for investors seeking tangible assets.

The transition from SLV to PSLV is not just a matter of preference but a strategic move by investors seeking more transparency and assurance in their silver holdings.

Inventory Levels and Their Impact on Prices

The interplay between inventory levels and silver prices is a critical aspect of the precious metals market. Inventory fluctuations can signal changes in supply and demand dynamics, influencing investor decisions and market sentiment. For instance, a significant rise in inventory, such as the increase to 424.085 million ounces, may suggest an oversupply, potentially leading to a price decrease.

However, inventory levels are not the only factor at play. The movement of investors from one investment vehicle to another, such as the shift from SLV to Sprott’s PSLV, can also impact the perceived scarcity and, consequently, the price of silver. This behavior reflects a preference for certain types of silver holdings and can be indicative of broader market trends.

The relationship between inventory levels and silver prices is complex and multifaceted, with various factors interconnecting to shape the market landscape.

The following table summarizes recent changes in silver inventory:

| Date | SLV Inventory Change (million oz) | Closing Inventory (million oz) |

|---|---|---|

| March 28 | +1.005 | 424.085 |

| March 27 | +1.691 | 423.079 |

Understanding these inventory changes is essential for investors looking to navigate the volatile silver market effectively.

Investor Sentiment and Market Predictions

The sentiment among investors is a powerful force that can drive market trends and influence silver prices. Market predictions are often a reflection of the collective mood and expectations of the investment community. Recent data suggests a cautious optimism, with many investors hedging their bets on precious metals as a safe haven amidst economic uncertainties.

The interplay between investor sentiment and market predictions is complex, yet it is a critical aspect to consider when analyzing future price movements of silver.

While some analysts remain skeptical, pointing to overvaluations in certain sectors, others see potential for growth in the wake of political and economic developments. The following list highlights key sentiments observed in the market:

- A belief in the market’s strength tied to political outcomes.

- Expectations of tech sector performance influencing broader indices.

- Anticipation of increased IPO activity as economic unknowns become clearer.

- Concerns over the ability to forecast market directions with high accuracy.

These sentiments, coupled with actual market performance, will shape the strategies of investors as they navigate the peaks and troughs of the silver market.

The Role of Global Economic Indicators

Influence of Bond Yields on Precious Metal Markets

The intricate relationship between bond yields and precious metal prices, particularly silver, is a cornerstone of market dynamics. Higher bond yields often lead to lower silver prices, as they increase the opportunity cost of holding non-yielding assets. Conversely, lower yields can enhance the appeal of silver as a safe-haven investment.

Recent trends in bond yields have shown a marked influence on the silver market. For instance, the rise in the USA 2 YR BOND YIELD to 4.601, up 3 basis points, has coincided with a dip in silver prices to 24.66. This correlation is a critical consideration for investors looking to time their market activities effectively.

The UK’s economic challenges, including interest rates and inflation, alongside global trends, play a significant role in shaping the silver market. Timing sales is crucial for maximizing profits.

Investors must remain vigilant of the bond market’s signals to navigate the precious metals landscape successfully. The table below summarizes recent bond yield movements and their corresponding impact on silver prices:

| Bond Yield | Change (Basis Points) | Silver Price (per ounce) |

|---|---|---|

| USA 2 YR | UP 3 | $24.66 |

| German 10 YR | UP TO +2.3180 | $24.54 |

| USA 10 YR | UP 3 | $24.66 |

Understanding these patterns is essential for strategic investment decisions, especially in a climate where the UK’s economic challenges impact the silver market.

Assessing the Impact of Currency Fluctuations

Currency fluctuations play a pivotal role in the valuation of precious metals, including silver. The strength of the US dollar, in particular, has a significant inverse relationship with silver prices. When the dollar appreciates, as it did in the first quarter, erasing half of the previous quarter’s losses, silver prices tend to fall. Conversely, a weaker dollar often leads to higher silver prices as it becomes cheaper for holders of other currencies to buy silver.

The recent volatility in the foreign exchange market, with the Japanese yen plunging to its weakest since 1990 and the yuan also tumbling, has contributed to the complexities of predicting silver’s trajectory. The Russian rouble’s stability against the dollar, despite geopolitical tensions, adds another layer to the intricate web of currency impacts on silver.

The interplay between currency values and silver prices underscores the necessity for investors to stay informed on global events and market trends. A keen understanding of these dynamics is essential for making sound investment decisions.

The table below illustrates the correlation between major currency movements and silver prices in the recent quarter:

| Currency | Q1 Movement | Impact on Silver Prices |

|---|---|---|

| USD | Appreciated | Negative |

| JPY | Weakened | Positive |

| CNY | Weakened | Positive |

| RUB | Stable | Neutral |

As investors navigate the precious metals market, it is crucial to monitor the ongoing shifts in currency values. The potential for a currency devaluation race, particularly in Asia, poses a risk that could lead to broader financial implications, affecting silver and other commodities.

Commodity Futures and Their Correlation with Silver

The relationship between commodity futures and silver prices is a complex interplay that reflects broader market sentiment and economic trends. Commodity futures contracts are agreements to buy or sell a specific quantity of a commodity at a predetermined price on a specified date in the future. These contracts are used by investors to hedge against price volatility or to speculate on price movements.

Recent trends in the COMEX silver futures have shown a correlation with the fluctuations in silver prices. For instance, a small increase in open interest contracts often precedes a rise in silver prices, indicating a bullish market sentiment. Conversely, a decrease in open interest may signal a bearish outlook. The table below summarizes recent changes in COMEX silver open interest and corresponding silver price movements:

| Date | COMEX OI Change | Silver Price Movement |

|---|---|---|

| Feb 20 | -3,385 contracts | Down $0.33 |

| Feb 15 | No change | Up $0.56 |

| Feb 14 | No change | Up $0.24 |

| Feb 13 | -504 contracts | Down $0.60 |

Investors should monitor these trends closely as they can provide valuable insights into future price directions. Understanding the nuances of these correlations can aid in making informed investment decisions.

It is also essential to consider the inventory levels of silver, as they can impact futures prices. For example, significant deposits or withdrawals from silver inventories, such as those seen in the SLV, can affect investor perception and consequently, the futures market. Stay informed on macroeconomic news and the gold-silver ratio to time silver sales effectively.

Strategic Investment Decisions in Volatile Times

Navigating the Shift in Commodity Investments

As the commodity markets continue to exhibit volatility, investors are seeking strategies to navigate market trends effectively. The recent surge in silver prices has prompted a reevaluation of investment portfolios, with a focus on diversifying assets and timing market entry and exit points for optimal returns.

In the context of silver’s performance, the following points are crucial for investors:

- Diversification across various commodities, including gold and silver, to mitigate risk.

- Regular investment to take advantage of dollar-cost averaging.

- Staying informed about market dynamics to make educated decisions.

- Knowing when to sell, which is as important as knowing when to buy.

The ability to adapt to market changes and adjust investment strategies accordingly is essential for long-term success in the commodities market.

Understanding the intricacies of the COMEX silver contracts and the implications of short-term versus long-term investment approaches will further empower investors to make informed decisions amidst the shifting landscape of commodity investments.

Understanding the COMEX Silver Contracts

The COMEX silver contracts are pivotal in the trading of silver futures, providing a standardized agreement for the future delivery of silver at an agreed-upon price. Open interest in these contracts is a key indicator of market sentiment and liquidity. As of recent data, the open interest at the COMEX in silver rose by a modest 198 contracts to 160,907, approaching the record high of 244,710 set on February 25, 2020.

The total registered silver currently stands at 45.829 million oz, with a combined total of registered and eligible silver at 287.737 million oz. It’s crucial to monitor these inventory levels as they can significantly influence silver prices on the market.

Investors and traders must understand the nuances of these contracts to effectively navigate the market. The table below summarizes the latest COMEX silver contract data:

| Date | Open Interest | Price Change | Total Registered (oz) | Total (Registered + Eligible) (oz) |

|---|---|---|---|---|

| Recent Data | 160,907 | $0.14 | 45.829 million | 287.737 million |

The COMEX silver contracts serve as a barometer for the health of the silver market, reflecting the balance between supply and demand dynamics.

Long-term vs Short-term Investment Approaches

In the realm of commodity investments, the dichotomy between long-term and short-term strategies is stark. Long-term investors often prioritize stability and gradual growth, looking for assets with strong free cash flow yields as a sign of a company’s ability to generate cash efficiently. Conversely, short-term investors may focus on immediate earnings potential, which can be influenced by factors such as profitability and capital expenditure (CapEx) levels.

- Long-term considerations:

- Emphasis on free cash flow yield

- Valuation relative to net asset value

- Year-over-year revenue growth

- Short-term considerations:

- Anticipated profitability

- Maintenance and growth CapEx

- Immediate return on investment

In navigating these investment waters, one must weigh the merits of each approach against their individual financial goals and risk tolerance. A balanced perspective, informed by market data and company performance metrics, is essential for making strategic decisions.

The table below succinctly captures key metrics that may influence investment decisions:

| Metric | Long-term Value | Short-term Impact |

|---|---|---|

| Free Cash Flow Yield | Positive | – |

| Price / Book (last 12 months) | 0.59 | May indicate undervaluation |

| Revenue Growth (last 12 months) | 12.95% | Solid increase |

| Anticipated Profitability | – | Critical |

Understanding these metrics and their implications can help investors align their strategies with their investment horizon and objectives.

Outlook and Projections for Silver’s Future

Expert Analyses and Market Forecasts

In the realm of precious metals, expert analyses often hinge on a myriad of factors, from macroeconomic indicators to the minutiae of market sentiment. Silver market dynamics include industrial demand, geopolitical events, and market speculation. Understanding these elements is not just academic; it’s a practical necessity for those engaged in selling silver bars in the UK or diversifying their investment portfolios.

The current peak in silver prices has prompted a reevaluation of traditional market forecasts, with experts now scrutinizing the underlying causes of this surge. While pinpointing exact future prices remains elusive, the consensus is that the interplay between supply and demand will continue to be a pivotal driver.

Analysts are closely monitoring the following key areas to gauge the future trajectory of silver prices:

- The rate of industrial consumption and its growth prospects

- Geopolitical stability and its impact on silver mining regions

- Innovations in financial products related to silver investments

- Speculative trading patterns and their influence on price volatility

Potential Risks and Opportunities for Investors

In the realm of precious metals, silver presents a unique set of risks and opportunities that investors must carefully navigate. Market volatility remains a significant risk, with prices susceptible to rapid changes due to various external factors, including financial, regulatory, or political events. The potential for information asymmetry also poses a risk, as investors may suffer losses due to a lack of understanding of market dynamics or the underlying technology of trading platforms.

The allure of silver, however, lies in its dual role as both an industrial metal and a monetary asset, which can lead to diverse investment opportunities. Its industrial demand, particularly in areas such as renewable energy and electronics, may bolster its value over time.

Investors should consider the following points:

- The importance of due diligence to mitigate the risks of information asymmetry.

- Monitoring global economic indicators that can influence silver prices.

- The potential for silver to act as a hedge against inflation in a diversified portfolio.

While the future commodity landscape is uncertain, silver’s versatility and historical significance suggest it may continue to hold a valuable position for strategic investors.

Silver’s Position in the Future Commodity Landscape

As investors and analysts look to the horizon, silver’s role in the future commodity market remains a subject of keen interest. Silver price charts in the UK show historical trends, highlighting silver’s resilience and value. The strategic inclusion of silver in investment portfolios is not just about capitalizing on its potential for appreciation but also about diversification. Diversifying with silver bullion can reduce risk and hedge against inflation, offering a stabilizing effect amidst market volatility.

The versatility of silver, from industrial demand to investment appeal, suggests that it will continue to be a significant player in the commodities market. Its dual role may well buffer it against the fluctuations that purely investment-driven assets face.

Looking ahead, the potential risks and opportunities for silver are multifaceted. While the digital revolution and green technologies drive industrial demand, investment demand is influenced by economic indicators and investor sentiment. The balance of these forces will shape silver’s trajectory in the commodities landscape.

Conclusion

As we navigate the currents of the UK’s precious metals market, the unprecedented peak of £0.73 per gram for silver stands as a beacon for investors and traders alike. The surge in silver’s value, amidst a dynamic landscape of fluctuating commodities and financial indices, underscores the metal’s enduring appeal and potential for wealth preservation. With inventory levels reaching significant heights and investors transitioning from SLV to Sprott’s PSLV, the market is witnessing a tangible shift in preference towards tangible assets. The intricate dance of supply and demand continues to play out on the global stage, with the COMEX and London markets experiencing notable activity in silver contracts. As we close this analysis, it is clear that silver’s soar is not only a reflection of current economic sentiments but also a testament to its intrinsic value in an ever-evolving marketplace.

Frequently Asked Questions

Why has the price of silver reached a peak of £0.73 per gram in the UK?

The peak in silver prices is attributed to a combination of factors such as market dynamics, investor behavior, and global economic indicators. Increased demand for silver as an investment, shifts in investor preference from ETFs like SLV to Sprott’s PSLV, and fluctuations in currency values have all played a role.

What is the significance of the inventory level of 424.085 million oz of silver?

The inventory level indicates the amount of silver available for trading and investment. A high inventory level, like the 424.085 million oz, can impact prices by suggesting a surplus, whereas a low inventory can indicate scarcity, potentially driving prices up.

How are bond yields influencing the precious metal markets?

Bond yields often move inversely to precious metals like silver. When bond yields are low, investors may seek alternative investments like silver to potentially earn higher returns, which can drive up its price.

What are COMEX Silver Contracts and why are they important for investors?

COMEX Silver Contracts are futures contracts that allow investors to buy or sell silver at a set price in the future. They are important as they provide a way to hedge against price volatility and offer a means to speculate on the future price of silver.

What are some potential risks and opportunities for silver investors in the current market?

Investors face risks such as market volatility and potential downturns in industrial demand. However, opportunities may arise from economic uncertainty, which often increases the appeal of precious metals as a safe-haven asset.

How should investors approach silver investment given the current all-time high prices?

Investors should carefully consider their long-term investment goals and risk tolerance. Diversifying their portfolio and staying informed about market trends and economic indicators can help in making strategic investment decisions during volatile times.

Related Articles

Current Spot Prices:

Gold: £59.69

Silver: £0.70

Products

-

Plain 500 Gram Silver Bar

From £407.95 Ex Vat -

Plain 250 Gram Silver Bar

From £217.62 Ex Vat -

Gold double eagle

£1,767.45 -

100 Gram Gold Bar

£5,873.66 -

10 Oz Silver Bar

£223.08