Finding the Best Gold to Buy in the UK

Understanding the Gold Market in the UK

The History of Gold in the UK

Gold has been valued in the United Kingdom (UK) for centuries and remains one of the world’s leading commodities. It has a long history of being used as a store of value and a medium of exchange. The UK has experienced several gold rushes, including one in 1852 at Auchtermuchty and Kinnesswood, and another in 1869 at Baile An. Gold mining in Scotland has been a significant industry, with gold reserves in the UK remaining stable at 310.29 tonnes. The UK is also a major importer of gold, with recent growth in gold reserves. In May 2022, the outstanding international reserves increased by approximately 5.6 million U.S. dollars. Gold continues to be sought after by individuals as a safe haven investment during times of economic instability.

Current Trends in Gold Buying

One important trend in gold buying is the live gold price. Investors closely monitor the price of gold as it fluctuates throughout the day. Websites like GoldCore provide up-to-date information on the live gold price in various currencies such as USD, GBP, and EUR. These prices are updated every 5 seconds and can be viewed in ounces, grammes, and kilos. Investors use this information to make informed decisions about when to buy or sell gold.

In addition to the live gold price, investors also consider other factors such as historical price trends, market conditions, and economic indicators. It is important to conduct thorough research and analysis before making any investment decisions. Some investors may also seek advice from financial experts or consult investment forums for insights and recommendations.

When buying gold, it is crucial to be aware of potential scams and counterfeit products. Investors should only purchase gold from reputable sellers and ensure that the gold has proper authenticity and certification. This helps protect against fraud and ensures the quality and value of the gold purchased.

To summarise, current trends in gold buying include closely monitoring the live gold price, conducting thorough research and analysis, and being cautious of scams and counterfeit products.

Factors Affecting Gold Prices in the UK

The price of gold in the UK is influenced by several factors. One important factor is the global demand for gold, which can be affected by economic conditions and investor sentiment. Changes in any of these sectors can affect the prices. For instance, an increase in demand for electronics, which often use silver and gold, can lead to a rise in gold prices. Another factor is the strength of the UK economy. When the economy is performing well, investors may have more confidence in other investment options, which can lead to a decrease in demand for gold and a decrease in prices. On the other hand, during times of economic instability, investors may turn to gold as a safe haven, increasing demand and driving up prices. Additionally, geopolitical events and government policies can also impact gold prices. For example, changes in trade policies or political tensions can affect the value of currencies, which in turn can influence gold prices. It’s important for investors to stay informed about these factors and conduct thorough market research and analysis before buying gold.

Types of Gold Available in the UK

Bullion Gold Coins

Bullion gold coins are a popular choice for investors looking to add physical gold to their portfolio. These coins are typically made from pure gold and are minted by government or private mints. They are available in various sizes, ranging from 1/10 ounce to 1 ounce, making them accessible to investors with different budgets. Bullion gold coins are highly liquid and can be easily bought or sold in the market. They are also considered a reliable store of value and a hedge against inflation. When purchasing bullion gold coins, it is important to buy from reputable sellers and consider the premium over the spot price of gold.

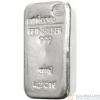

Gold Bars

Gold bars are one of the most popular forms of investing in gold. They are available in various sizes, ranging from 1g to 1kg, allowing investors to choose the size that suits their budget and investment goals. Gold bars are typically made of pure gold and are stamped with their weight, purity, and a unique serial number for authentication. They can be easily stored and transported, making them a convenient option for investors. When buying gold bars, it is important to consider factors such as the reputation of the seller, the purity of the gold, and any additional costs such as storage fees.

Gold Jewellery

Gold jewellery is a popular choice for many people in the UK. It is not only a fashion statement but also a valuable investment. When buying gold jewellery, it is important to consider the purity of the gold, which is usually indicated by a hallmark. Additionally, the weight and size of the jewellery can affect its value. It is recommended to buy gold jewellery from reputable sellers who provide authenticity and certification. Diversify Your Portfolio: Investing in gold jewellery can be a great way to diversify your investment portfolio and protect against market volatility.

Gold ETFs

Gold ETFs, or Exchange-Traded Funds, are investment products that track the price of gold. They are a popular choice for investors looking to gain exposure to the gold market without physically owning gold. In the UK, some of the best gold ETFs to consider are the Royal Mint Physical gold ETC and Wisdom Tree Core. These ETFs provide investors with the opportunity to invest in physical gold and have shown strong performance with an annual return of 16 percent. It is important for investors to research and analyse the performance and track record of different gold ETFs before making an investment decision.

Where to Buy Gold in the UK

High Street Jewellers

When it comes to buying gold in the UK, one popular option is to visit high street jewellers. These jewellers have a wide selection of gold jewellery and other gold items available for purchase. They often have knowledgeable staff who can assist you in finding the perfect piece of gold that suits your preferences and budget. Additionally, high street jewellers may offer services such as resizing, cleaning, and repairs for your gold jewellery. It’s important to do your research and choose a reputable high street jeweller to ensure the quality and authenticity of the gold you are buying.

Online Gold Dealers

When it comes to buying gold online, there are several reputable dealers in the UK. These online platforms provide a convenient and secure way to purchase gold from the comfort of your own home. One important factor to consider when choosing an online gold dealer is their reputation and customer reviews. Look for dealers that have a track record of delivering high-quality gold and excellent customer service. Additionally, it’s essential to compare prices and fees to ensure you’re getting the best value for your investment. Take the time to research different online gold dealers and read customer testimonials before making your purchase. Remember, investing in gold is a significant financial decision, so it’s crucial to choose a trustworthy and reliable online dealer.

Auction Houses

Auction houses are a popular option for buying gold in the UK. They offer a wide range of gold products, including bullion coins, gold bars, and gold jewellery. One advantage of buying from auction houses is the potential to find unique and rare pieces that may not be available elsewhere. However, it’s important to do thorough research and set a budget before participating in an auction. Additionally, keep in mind that auction prices may include buyer’s premiums and other fees. Overall, auction houses can be a great place to find high-quality gold items and potentially make valuable additions to your collection or investment portfolio.

Gold Exchanges

Gold exchanges are platforms where investors can buy and sell gold. These exchanges provide a convenient and secure way to trade gold, allowing investors to access the gold market without physically owning the metal. One of the leading gold exchanges in the UK is the Royal Mint, which offers gold-backed securities such as ETCs. Other notable gold exchanges include Wisdom Tree Core, Xtrackers IE, and boerse.de, which are popular worldwide. These exchanges track the price of gold and provide opportunities for investors to profit from fluctuations in the market. It is important for investors to research and choose reputable gold exchanges that offer transparent pricing and reliable services.

Evaluating the Quality of Gold

Purity and Hallmarks

When buying gold, it is important to understand the concept of purity and hallmarks. The fineness mark denotes the purity of the metal, measured in parts per thousand in relation to the UK standard. For example, 9ct Gold has a fineness of 375, meaning it is 37.5% pure gold. This information is crucial in determining the value and quality of the gold you are purchasing. To ensure you are getting genuine gold, always look for the appropriate hallmarks, which indicate that the gold has been tested and certified. These hallmarks serve as a guarantee of authenticity and can be found on reputable gold products.

Weight and Size

When buying gold, it’s important to consider the weight and size of the gold bars or coins. The weight of gold is typically measured in troy ounces or grammes, with troy ounces being the standard measurement in the UK. Gold bars come in various sizes, ranging from as small as 0.032 troy ounces to as large as 32.15 troy ounces. Similarly, gold coins are available in different weights, such as 1 gramme, 10 grammes, and 1 troy ounce. The size and weight of the gold you choose will depend on your investment goals and budget. It’s advisable to consult with a reputable gold dealer to determine the best weight and size for your needs.

Authenticity and Certification

When buying gold in the UK, it is crucial to ensure its authenticity and certification. Certificates serve as concrete proof of the quality and value of your investment, making them essential for UK investors looking to buy or sell gold. These certificates provide assurance that the gold you are purchasing is genuine and meets the required standards. They also help establish the purity of the gold, which is an important factor in determining its value. Therefore, it is recommended to always ask for certificates when buying gold.

In addition to certificates, there are various standards and accreditations that can further validate the authenticity of gold. These standards ensure that the gold has been tested and verified by reputable organisations. Some common standards include the London Bullion Market Association (LBMA) Good Delivery List and the Responsible Jewellery Council (RJC) certification. These accreditations provide additional assurance of the gold’s authenticity and ethical sourcing.

To summarise, when buying gold in the UK, it is essential to prioritise authenticity and certification. Requesting certificates and looking for reputable standards and accreditations can help ensure that you are making a secure and reliable investment in gold.

Factors to Consider When Buying Gold

Investment Goals

When buying gold, it is important to consider your investment goals, budget and affordability, storage and security, and market research and analysis. Your investment goals will determine the type of gold you should buy, whether it’s for long-term wealth preservation or short-term profit. It’s crucial to set a budget and determine how much you can afford to invest in gold. Additionally, you need to consider the storage and security of your gold, whether you prefer to store it at home or in a secure vault. Lastly, conducting thorough market research and analysis will help you make informed decisions and identify the best opportunities in the gold market.

Budget and Affordability

When buying gold, it is important to consider your budget and affordability. Gold prices can vary greatly depending on factors such as purity, weight, and market demand. Before making a purchase, determine how much you are willing to spend and stick to your budget. Additionally, consider the affordability of storing and securing your gold. Storage options such as safe deposit boxes or home safes may incur additional costs. It is crucial to factor in these expenses when evaluating the overall affordability of buying gold.

Storage and Security

When it comes to buying gold, storage and security are crucial considerations. After investing in gold, you need to ensure that it is stored safely and securely. There are two main options for storage:

-

Secure Vault Facility: You can choose to have your gold stored in a secure vault facility. This provides maximum protection against theft or damage.

-

Insured Delivery: Alternatively, you can arrange for insured delivery of your gold to your home. This option allows you to physically possess your gold while still ensuring it is protected.

It is important to carefully consider which storage option is best for you based on your individual needs and preferences. Additionally, it is recommended to have insurance coverage for your gold to provide further protection.

Remember, always prioritise the security of your gold investment to safeguard your wealth.

Market Research and Analysis

Market research and analysis are crucial steps in the process of buying gold. Before making any investment, it is important to gather information and evaluate the market trends. One important factor to consider is the current price of gold. Monitoring the price fluctuations can help you make an informed decision and time your purchase effectively.

Additionally, it is essential to research the reputation and credibility of the seller. Look for reputable sellers who have a track record of providing genuine and high-quality gold.

Furthermore, consider the demand and supply dynamics of the gold market. Understanding the factors that affect the supply and demand can give you insights into the potential future price movements.

Lastly, conducting a thorough comparison of different sellers and their offerings is recommended. Compare prices, customer reviews, and additional services provided by each seller to ensure you are getting the best value for your investment.

Selling Gold in the UK

Selling to a Jeweller

When selling your gold to a jeweller, it’s important to consider a few key factors. First, make sure you have a clear understanding of the current market price for gold. This will help you negotiate a fair price for your gold. Additionally, it’s a good idea to shop around and get quotes from multiple jewellers to ensure you’re getting the best offer. Finally, don’t forget to take into account any fees or commissions that the jeweller may charge. By keeping these factors in mind, you can maximise your profit when selling your gold to a jeweller.

Selling Online

Selling gold online can be a convenient and efficient way to turn your gold into cash. There are several online platforms and websites that offer the option to sell gold quickly and easily. One such platform is Cheshire Gold Xchange, which allows you to sell your gold online and provides a free prepaid selling pack. With Cheshire Gold Xchange, you can expect high prices for your gold and get quick cash for your gold. It’s important to choose a reputable online seller when selling gold to ensure a smooth and secure transaction.

Here are some tips for selling gold online:

- Do your research: Before choosing an online platform to sell your gold, research different options and compare prices to ensure you get the best deal.

- Consider the reputation: Look for online sellers with positive reviews and a good reputation for fair prices and reliable service.

- Check the process: Understand the process of selling gold online, including how to package and ship your gold securely.

- Be aware of fees: Some online platforms may charge fees for selling gold, so make sure to factor in any additional costs.

Selling gold online can be a convenient and profitable way to sell your gold, but it’s important to take the necessary precautions and choose a reputable platform for a smooth and secure transaction.

Selling at Auction

Selling your gold at an auction can be a great way to get a fair price for your items. Auctions attract a wide range of buyers, including collectors, investors, and dealers, which can drive up the bidding and result in higher prices. Before selling at an auction, it’s important to research the auction house and understand their fees and commission rates. Additionally, consider setting a reserve price to ensure that your gold doesn’t sell for less than its value. Participating in an auction can be an exciting and profitable experience for selling your gold.

Selling to a Gold Dealer

Selling your gold to a reputable gold dealer can ensure that you get a fair price for your precious metal. One option is to sell your gold to The Hatton Garden Gold Dealer in London. With these tips, you can confidently sell your gold for a fair price. Our process at London Gold Centre in Hatton Garden is straightforward: bring your unwanted gold to our shop, and our experts will assess its value and make you an offer. If you accept the offer, you will receive payment on the spot. Selling to a gold dealer is a convenient and reliable way to turn your gold into cash.

Tips for Buying Gold in the UK

Do Your Research

When it comes to buying gold, conducting thorough research is crucial. Start by understanding the current trends in the gold market in the UK and the factors that affect gold prices. Consider your investment goals and budget, as well as the storage and security options available. It’s also important to research and choose reputable sellers, such as members of the British Numismatic Trade Association. Investing in gold should be part of a diversified portfolio, and seeking professional investment advice is recommended. Remember, the historic performance of gold is not indicative of future performance.

Buy from Reputable Sellers

When buying gold, it is crucial to ensure that you are purchasing from reputable sellers. Reputable sellers have a track record of providing high-quality gold and reliable service. Here are some tips to help you find reputable sellers:

- Research the seller’s reputation and customer reviews.

- Look for sellers who are members of recognised industry associations.

- Check if the seller provides authentic certification for their gold.

- Consider buying from established high street jewellers or reputable online gold dealers.

By buying from reputable sellers, you can have peace of mind knowing that you are getting genuine gold of the highest quality.

Consider the Premium

When buying gold, it’s important to consider the premium. The premium refers to the additional cost you pay above the spot price of gold. This cost includes factors such as manufacturing, distribution, and dealer fees. Lower premiums can be achieved by buying in bulk or purchasing larger quantities of gold. By doing so, you can reduce the additional costs associated with smaller purchases. However, it’s essential to balance the premium with other factors like storage and security. It’s recommended to compare prices from different sellers and evaluate the overall value before making a purchase.

Here are some tips to consider when evaluating the premium:

- Compare prices from multiple sellers to ensure you’re getting the best deal.

- Take into account the additional costs associated with smaller purchases.

- Consider the storage and security options available for your gold.

- Balance the premium with other factors like authenticity and certification.

Remember, the premium is just one aspect to consider when buying gold. It’s important to do thorough research and consider your investment goals before making a decision.

Diversify Your Portfolio

Diversifying your portfolio is a crucial strategy for mitigating risk and maximising returns. By investing in a variety of assets, including gold, you can reduce the impact of market fluctuations and protect your wealth. Gold has historically been a safe haven investment, providing stability during times of economic uncertainty. It can act as a hedge against inflation and currency devaluation. Additionally, gold has a low correlation with other financial assets, making it an effective diversification tool. Consider allocating a portion of your portfolio to gold to enhance its resilience and potential for long-term growth.