Key Takeaways

| Key Point | Summary |

|---|---|

| Understanding the Gold Market | Essential for making informed decisions; involves researching reputable dealers, differentiating types of gold, and considering market conditions. |

| Choosing the Right Dealer | Importance of researching reputable dealers, checking customer reviews, and verifying credentials. |

| Types of Gold Available | Differentiating between bullion and coins, understanding their pros and cons. |

| Market Conditions | Keeping track of gold prices and trends, understanding factors influencing gold prices. |

Navigating the World of Gold Bullion: Finding the Best Dealer

Understanding the UK Gold Market

Navigating the world of gold investment requires a solid understanding of the market. In the UK, this means knowing the ins and outs of gold bullion and coins. For instance, distinguishing between silver pandas and American buffalo gold coins is crucial. Bullion refers to pure gold bars, whereas coins like the 1-ounce Gold Australian Nugget offer both collectible and investment value【21†source】.

Choosing the Best Gold Bullion Dealer

When selecting a gold bullion dealer, the importance of credibility cannot be overstated. Opting for a dealer with a proven track record, like Gold Bullion Dealers, guarantees safe and reliable transactions. By exploring options like the 1-ounce Gold Philharmonic and the Isle of Man 1 oz Gold Noble, investors ensure they’re dealing with quality products. Checking a dealer’s customer reviews and credentials, such as those associated with gold double eagles, is imperative for a secure investment.

Types of Gold for Investment

Diversifying your portfolio with different types of gold, such as silver Britannias and the unique 10oz Lunar Beast, can be a wise investment strategy. Bullion provides high purity levels and standardized forms, making it a favored choice for many. Coins, like the Silver Maple and Silver Pharmonica, offer additional collectible value but may come with higher premiums.

Analyzing Current Market Conditions

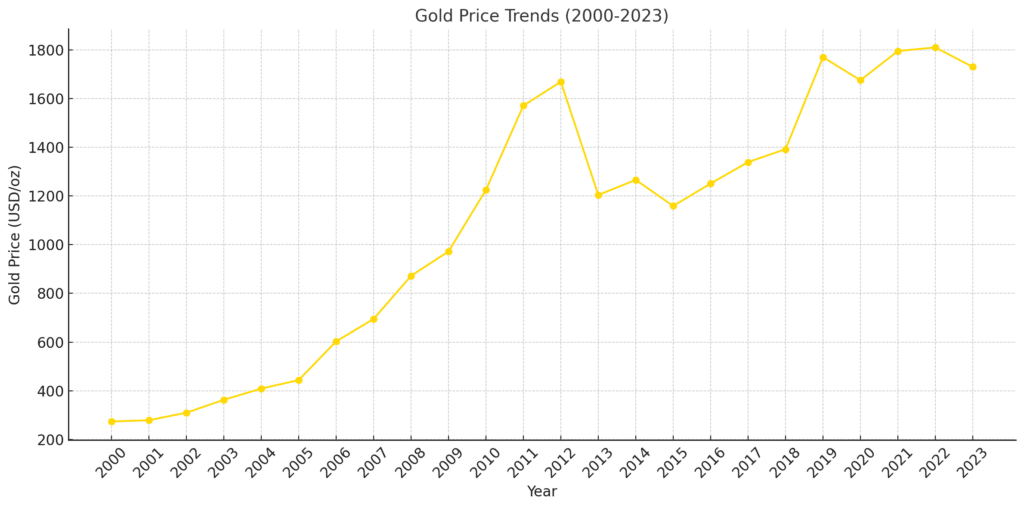

A savvy investor must always keep an eye on market conditions. This involves tracking trends and understanding the factors influencing gold prices, like economic indicators and geopolitical events. For instance, when considering a purchase like the 1/2oz Lunar Silver Coin or the Silver Kookaburra, it’s vital to consider current gold prices and market stability. This knowledge can guide whether to buy or sell at any given time.

Secure Investment with Certified Bullion

When investing in gold, authenticity is key. Products like the 2.5g Umicore Gold Bar and the Metalor 5 Gram Gold Bar are prime examples of certified gold that offer security and peace of mind. These bars are minted by reputable institutions, ensuring their purity and value. Trustworthy dealers like Gold Bullion Dealers provide these high-quality options, which are essential for serious investors.

Diverse Gold Bullion Portfolio

Creating a diverse portfolio is critical for mitigating risks and maximizing returns. This could include a range of products, from smaller items like the Umicore 1 Ounce Gold Bar to larger investments such as the Metalor 500 Gram Silver Bar. Diversification ensures that your investment is spread across different types of gold, balancing risk and reward effectively.

The Convenience of Online Purchases

The digital age has brought the convenience of online purchases to the forefront. With options like the Metalor 250 Gram Silver Bar and the Metalor 10 Gram Gold Bar available at a click, investors can easily expand their portfolios from the comfort of their homes. Gold Bullion Dealers offers a user-friendly online platform, making the process of buying gold straightforward and secure.

The Assurance of Physical Inspection

Despite the ease of online transactions, the option to physically inspect your investment, like with the Metalor 20 Gram Gold Bar or the Metalor 50 Gram Gold Bar, adds a layer of trust and satisfaction. Visiting a dealer’s office, like Gold Bullion Dealers located in Birmingham’s Jewelry Quarter, allows investors to see and feel the quality of products like the Metalor 100 Gram Gold Bar, ensuring their investment meets expectations.

Long-Term Investment Strategies

Investing in gold, such as in the Metalor 250 Gram Gold Bar or the Metalor 500 Gram Gold Bar, is often considered a long-term strategy. It’s important to assess how these investments fit into your broader financial goals. Gold’s stability and potential for appreciation make it an attractive option for diversifying and strengthening your investment portfolio.

The Legacy of Gold Investment

Gold investment, especially in items like the Metalor 1 Oz Gold Bar or the Umicore 1 Gram Gold Bar, carries a legacy of value and trust. It’s a tangible asset that has stood the test of time, offering a sense of security in an ever-changing financial landscape. Gold Bullion Dealers, with their range of products and expertise, provide a gateway to this timeless investment.

Gold as a Hedge Against Inflation

In times of economic uncertainty, gold, like the Umicore 1 Kilo Silver Bar or the Umicore 100 Gram Gold Bar, acts as a hedge against inflation. Its intrinsic value and limited supply make it a stable investment, especially during periods of currency devaluation and inflationary pressures. This characteristic underscores the importance of including gold in a balanced investment portfolio.

Conclusion: The Gold Bullion Dealers Advantage

Choosing the best gold bullion dealer, like Gold Bullion Dealers, ensures access to a wide range of high-quality products, expert advice, and secure transactions. Whether it’s for a small investment like the Umicore 250 Gram Gold Bullion Bar or larger acquisitions such as the Umicore 500 Gram Gold Bar, their expertise and reputation provide a solid foundation for your gold investment journey.