Understanding Gold Bullion: A Comprehensive Guide

Key Takeaways:

| Aspect | Description |

|---|---|

| Definition | Gold bullion is high-purity physical gold, primarily used as an investment. |

| Forms | It comes in various forms, including bars, coins, rounds, and ingots. |

| Purity | The purity of gold bullion is typically at least 99.5%. |

| Investment Appeal | A popular choice for wealth preservation and portfolio diversification. |

| Physical Tangibility | Offers a tangible asset option compared to digital or paper assets. |

Gold bullion, a term that evokes images of gleaming bars and valuable coins, is a staple in the world of precious metals. This guide delves into the essence of gold bullion, its forms, and its significance as an investment vehicle.

What Exactly Is Gold Bullion?

Gold bullion is fundamentally physical gold in a form that is highly pure and valuable. Its primary allure lies in its purity and intrinsic value, making it a preferred choice for investors and collectors alike. Unlike gold jewelry or gold in financial instruments like futures or ETFs, gold bullion’s worth is based on its precious metal content rather than any form of artistic craftsmanship or government backing.

Forms of Gold Bullion

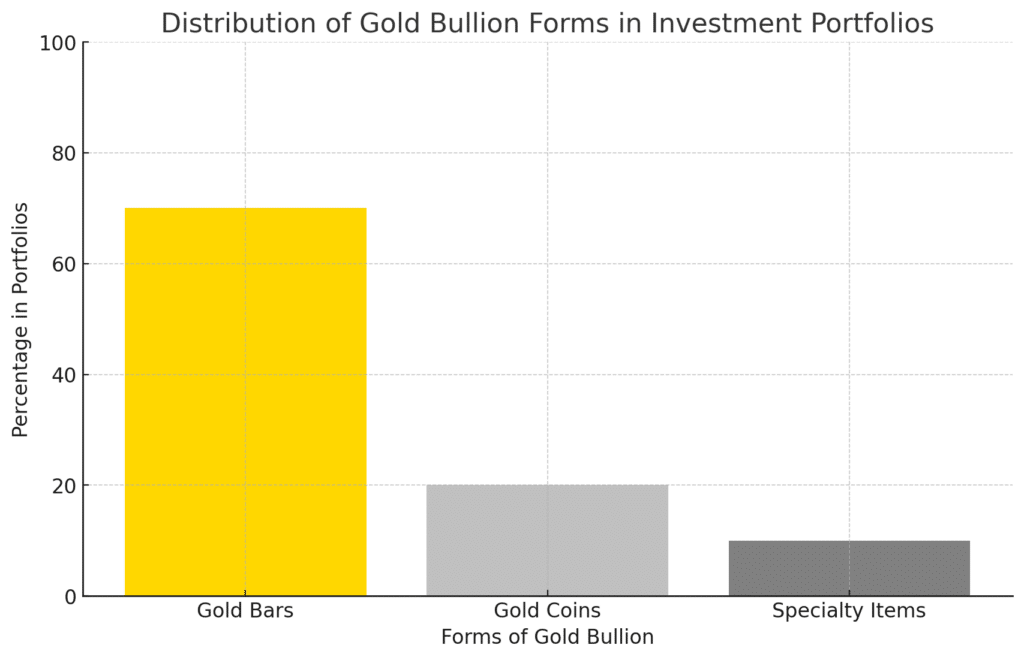

Diving into the various forms of gold bullion, one finds a range of options from bars to coins. These forms include:

- Gold Bars: The quintessential form of bullion, gold bars are valued for their large size and weight, making them a staple in investment portfolios. Examples include the Metalor 1 Kilo Gold Bar and the Umicore 500 Gram Gold Bar.

- Gold Coins: Coins like the 1 Ounce Britannia and the 1 Ounce American Eagle offer a combination of collectibility and investment value.

- Specialty Items: Unique forms like rounds and ingots, which might be less common but still hold significant value for collectors and investors.

Why Invest in Gold Bullion?

Investing in gold bullion offers several advantages:

- Wealth Preservation: Gold has historically maintained its value over time, making it a reliable store of wealth.

- Diversification: Adding gold to an investment portfolio can reduce risk by diversifying assets.

- Tangible Assets: In an increasingly digital world, gold bullion provides a physical asset that stands apart from digital investments.

The Role of Gold Bullion in the Modern Economy

Gold bullion plays a critical role in the modern economy, with governments and central banks holding substantial reserves. It’s a symbol of stability and a hedge against inflation and economic uncertainty.

How to Start Investing in Gold Bullion

For those new to gold investing, starting with small purchases like the Umicore 1 Gram Gold Bar or the 2.5 Gram Gold Bar can be a wise approach. As confidence and knowledge grow, investors can explore larger options like the Metalor 500 Gram Gold Bar or even the 1 Kilo Gold Bar.

The Historical Journey of Gold Bullion

Gold bullion’s history is as rich and varied as the metal itself. From ancient civilizations valuing gold for its rarity and beauty to modern economies recognizing it as a symbol of wealth and security, gold’s journey through time is fascinating.

Gold’s Timeless Appeal

- Ancient Civilizations: Gold has been treasured since the earliest civilizations for its lasting beauty and rarity.

- Currency Standard: For centuries, gold was the backbone of many monetary systems, symbolizing trust and stability in currencies.

Evolving Use of Gold

- From Ornament to Investment: While initially valued for decorative purposes, gold’s role evolved into a reliable investment and a hedge against economic instability.

Factors Influencing Gold Bullion’s Value

- Market Demand: Investment trends can significantly influence gold prices.

- Global Economy: Economic uncertainties often lead to increased demand for gold as a safe investment.

- Currency Fluctuations: The strength of major currencies, like the USD, can impact gold prices inversely.

Investment Strategies for Gold Bullion

Investing in gold bullion can be approached in multiple ways:

- Regular Purchases: Building a gold portfolio through regular purchases, such as acquiring 20 Gram Gold Bars or 50 Gram Gold Bars.

- Diverse Forms: Mixing different forms of gold, from 1 Ounce Gold Bars to Gold Sovereigns, to diversify the investment.

Storing and Securing Gold Bullion

The storage and security of gold bullion are paramount. Options include:

- Home Safes: For smaller collections or personal access needs.

- Bank Vaults: Offering high security for larger investments.

- Insured Storage Facilities: Providing peace of mind with insured protection.

The Online Gold Bullion Market

The rise of online platforms has made buying gold bullion more accessible than ever. Websites like Gold Bullion Dealers offer a wide range of products, from 1 Gram Gold Bars to 1 Kilo Gold Bars, making it easy for investors to purchase and track their investments securely and conveniently.

Choosing Quality Gold Bullion

When it comes to selecting gold bullion, quality and authenticity are crucial. Here’s how to ensure you’re making a wise investment:

Understanding Gold Purity

- Gold Purity Standards: The purity of gold bullion is typically measured in karats or fineness. Investment-grade gold is usually 24 karats, equivalent to 99.5% or higher in purity.

- Hallmarks and Certifications: Look for hallmarks and certifications from reputable sources to guarantee the gold’s purity and authenticity. Products like the Metalor 100 Gram Gold Bar often come with such assurances.

Selecting Reputable Dealers

- Established Dealers: Choose dealers with a strong reputation and a track record of quality, like Gold Bullion Dealers.

- Transparency: Opt for dealers who provide clear information about their products, pricing, and policies.

The Role of Gold Bullion in Diversified Portfolios

Gold bullion plays a critical role in diversified investment portfolios. Here’s why:

- Hedge Against Inflation: Gold often retains its value, even during periods of high inflation.

- Low Correlation with Other Assets: Gold’s price movements are generally not closely linked with stock or bond markets, making it an excellent diversification tool.

Portfolio Allocation Strategies

- Percentage Allocation: Financial advisors often recommend allocating a certain percentage of an investment portfolio to gold, depending on individual risk tolerance and investment goals.

- Regular Rebalancing: Regularly rebalancing your portfolio to maintain the desired gold allocation is crucial, especially during market fluctuations.

Gold Bullion and Retirement Planning

Gold bullion is also a valuable component in retirement planning:

- Long-Term Stability: Gold’s historical long-term stability makes it a prudent choice for retirement portfolios.

- Diversification in Retirement Accounts: Including gold in retirement accounts, such as self-directed IRAs, can provide additional security and diversification.

Gold Bullion as an Inheritance

- Tangible Legacy: Gold bullion can be a meaningful and lasting inheritance, holding value across generations.

- Estate Planning: Incorporating gold into estate planning ensures a portion of your wealth is preserved in a universally recognized asset.

Navigating the Gold Bullion Market

Understanding market trends and staying informed is key to successfully navigating the gold bullion market. Regularly monitoring market conditions and consulting with financial advisors can help make informed decisions.

- Market Research: Keep up with global economic trends and their potential impact on gold prices.

- Investment Timing: While timing the market can be challenging, understanding market cycles can help in making strategic buying or selling decisions.

The Future Outlook for Gold Bullion

As we look towards the future, the outlook for gold bullion remains a topic of interest among investors and financial experts. Here are some key considerations:

Predicting Gold Prices

- Market Uncertainties: Factors such as global economic stability, geopolitical events, and currency fluctuations will continue to influence gold prices.

- Sustained Demand: The ongoing demand for gold in technology, jewelry, and investment suggests a steady interest in gold bullion.

Ethical Considerations in Gold Investing

Ethical investing has gained prominence, and gold is no exception:

- Responsible Sourcing: Opt for gold from dealers who prioritize ethically sourced gold, considering the environmental and social impact of gold mining.

- Certified Gold: Look for certifications that ensure gold is sourced responsibly, such as the Umicore 100 Gram Gold Bar, known for its commitment to ethical gold sourcing.

Conclusion and Next Steps

Understanding “what is gold bullion” is just the beginning of your journey into the world of precious metals investing. Gold bullion offers a unique blend of security, value retention, and investment potential.

Your Path to Gold Bullion Investment

- Start Small: Begin with smaller purchases, like the 1 Gram Gold Bar or the 2.5 Gram Gold Bar, to build your confidence.

- Diversify: Consider different forms of gold, such as coins and bars, to diversify your portfolio.

- Stay Informed: Keep abreast of market trends and seek advice from financial experts to make informed decisions.

Gold bullion is not just an investment; it’s a symbol of enduring value and a testament to the timeless allure of gold. Whether you’re a seasoned investor or new to the world of precious metals, the journey into gold bullion investing is filled with opportunity and potential.